毎日最新版の記事…を公開しています。月曜日から金曜日までの平日更新。

| SBIラップ | おおぶねJapan | ひふみ投信 | |

| 毎月積立額 | 3万円 | 3万円 | 3万円 |

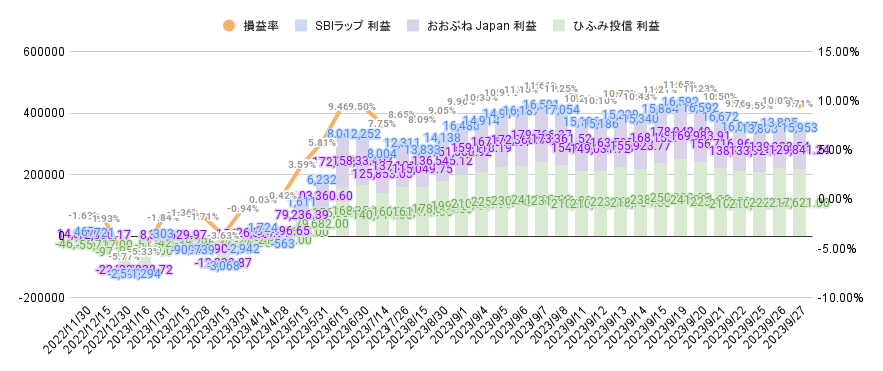

推移( 左側:積上損益額、右側:損益率 )

最近の株のトレンドは読みづらいことを反映して、投資信託も上がったり下がったりしてます。

堅調に推移してたけど、最近の空気感は下がりが続いてますね。今回も下落。

利益も下がってきてますね。40万円を切ってしまった。

SBIラップ

市場動向を先読みし投資配分を最適化 グローバルインデックスを上回るパフォーマンスを目指す

SBIラップは、微増

| 日付 | 資産総額 | 評価損益 | 評価損益率 | 米国株式 | 先進国株式 | 新興国株式 | 米国債券 | 米国ハイイールド | 新興国債券 | 米国不動産 | ゴールド | 現金 |

| 2023/9/27 | 215,953 | 15,953 | 7.39% | 1.90% | 2.00% | 18.70% | 41.50% | 6.50% | 6.50% | 1.90% | 19.80% | 1.30% |

| 2023/9/26 | 213,805 | 13,805 | 6.46% | 1.90% | 2.00% | 18.60% | 41.50% | 6.50% | 6.50% | 1.90% | 19.90% | 1.30% |

| 2023/9/25 | 213,805 | 13,805 | 6.46% | 1.90% | 2.00% | 18.60% | 41.50% | 6.50% | 6.50% | 1.90% | 19.90% | 1.30% |

| 2023/9/22 | 216,867 | 16,867 | 7.78% | 2.00% | 2.00% | 18.90% | 41.40% | 6.50% | 6.50% | 2.00% | 19.50% | 1.30% |

| 2023/9/21 | 216,672 | 16,672 | 7.69% | 2.00% | 2.00% | 18.90% | 41.40% | 6.50% | 6.50% | 2.00% | 19.50% | 1.30% |

| 2023/9/20 | 216,592 | 16,592 | 7.66% | 2.00% | 2.00% | 18.90% | 41.40% | 6.50% | 6.50% | 2.00% | 19.50% | 1.30% |

| 2023/9/19 | 216,592 | 16,592 | 7.66% | 2.00% | 2.00% | 18.90% | 41.40% | 6.50% | 6.50% | 2.00% | 19.50% | 1.30% |

| 2023/9/15 | 215,884 | 15,884 | 7.36% | 2.00% | 2.00% | 18.80% | 41.50% | 6.50% | 6.50% | 2.00% | 19.60% | 1.30% |

| 2023/9/14 | 215,340 | 15,340 | 7.12% | 2.00% | 2.00% | 18.80% | 41.40% | 6.50% | 6.50% | 2.00% | 19.60% | 1.30% |

| 2023/9/13 | 215,229 | 15,229 | 7.08% | 2.00% | 2.00% | 18.70% | 41.50% | 6.50% | 6.50% | 2.00% | 19.60% | 1.30% |

| 2023/9/12 | 215,186 | 15,186 | 7.06% | 2.00% | 2.00% | 18.60% | 41.50% | 6.50% | 6.50% | 2.00% | 19.60% | 1.30% |

| 2023/9/11 | 215,186 | 15,186 | 7.06% | 2.00% | 2.00% | 18.60% | 41.50% | 6.50% | 6.50% | 2.00% | 19.60% | 1.30% |

| 2023/9/8 | 217,054 | 17,054 | 7.86% | 1.90% | 1.90% | 36.50% | 29.50% | 1.90% | 1.90% | 1.80% | 19.00% | 5.60% |

| 2023/9/7 | 216,591 | 16,591 | 7.66% | 1.90% | 1.90% | 36.40% | 29.40% | 1.90% | 1.90% | 1.90% | 19.00% | 5.60% |

| 2023/9/6 | 216,187 | 16,187 | 7.49% | 1.90% | 1.90% | 36.10% | 29.60% | 1.90% | 1.90% | 1.90% | 19.10% | 5.70% |

| 2023/9/5 | 214,914 | 14,914 | 6.94% | 1.90% | 1.90% | 36.10% | 29.60% | 1.90% | 1.90% | 1.90% | 19.10% | 5.70% |

| 2023/9/4 | 214,914 | 14,914 | 6.94% | 1.90% | 1.90% | 36.10% | 29.60% | 1.90% | 1.90% | 1.90% | 19.10% | 5.70% |

| 2023/9/1 | 216,486 | 16,486 | 7.62% | 1.90% | 1.90% | 36.40% | 29.50% | 1.90% | 1.90% | 1.90% | 19.00% | 5.60% |

| 2023/8/30 | 204,138 | 14,138 | 6.93% | 2.00% | 2.00% | 38.00% | 31.10% | 2.00% | 2.00% | 1.90% | 19.90% | 1.10% |

| 2023/8/15 | 203,833 | 13,833 | 6.79% | 2.00% | 2.00% | 38.40% | 30.90% | 2.00% | 2.00% | 1.90% | 19.60% | 1.10% |

| 2023/7/26 | 192,311 | 12,311 | 6.40% | 2.00% | 2.00% | 48.30% | 20.70% | 2.00% | 2.00% | 2.00% | 20.00% | 1.00% |

| 2023/7/14 | 187,654 | 8,004 | 4.27% | 2.00% | 2.00% | 48.40% | 20.80% | 2.00% | 2.00% | 2.00% | 19.90% | 1.00% |

| 2023/6/30 | 181,902 | 12,252 | 6.74% | 2.00% | 2.00% | 48.70% | 21.00% | 2.00% | 2.00% | 2.00% | 19.40% | 1.00% |

| 2023/6/15 | 177,807 | 8,063 | 4.53% | 2.00% | 2.00% | 48.50% | 20.90% | 2.00% | 2.00% | 2.00% | 19.70% | 1.00% |

| 2023/5/31 | 165,976 | 6,232 | 3.75% | 2.00% | 2.00% | 48.20% | 21.20% | 2.00% | 2.00% | 1.90% | 19.60% | 1.00% |

| 2023/5/15 | 161,440 | 1,611 | 1.00% | 2.00% | 2.00% | 48.10% | 21.10% | 2.00% | 2.00% | 2.00% | 19.90% | 1.00% |

| 2023/5/1 | 130,525 | 698 | 0.53% | 2.00% | 2.50% | 47.90% | 21.10% | 2.00% | 2.00% | 2.00% | 19.60% | 1.00% |

| 2023/4/28 | 129,264 | -563 | -0.44% | 2.00% | 2.50% | 47.30% | 21.40% | 2.00% | 2.00% | 2.00% | 19.90% | 1.00% |

| 2023/4/14 | 131,621 | 1,724 | 1.31% | 2.00% | 2.40% | 48.10% | 20.90% | 2.00% | 2.00% | 2.00% | 19.60% | 1.00% |

| 2023/3/31 | 126,934 | -2,942 | -2.32% | 1.90% | 9.40% | 48.60% | 9.30% | 2.00% | 4.90% | 1.80% | 21.00% | 1.00% |

| 2023/3/15 | 126,875 | -3,068 | -2.42% | 1.90% | 9.60% | 48.60% | 9.40% | 2.00% | 5.10% | 1.90% | 20.40% | 1.00% |

| 2023/2/28 | 99,153 | -739 | -0.75% | 4.30% | 2.60% | 43.20% | 15.40% | 2.60% | 9.30% | 1.90% | 19.70% | 1.00% |

| 2023/2/15 | 99,030 | -909 | -0.92% | 4.30% | 2.60% | 43.30% | 15.20% | 2.60% | 9.20% | 2.00% | 19.80% | 1.00% |

| 2023/1/31 | 80,078 | 303 | 0.38% | 17.20% | 6.10% | 31.70% | 10.90% | 6.10% | 5.60% | 2.00% | 19.50% | 1.00% |

| 2023/1/16 | 78,481 | -1,294 | -1.65% | 17.20% | 6.10% | 31.30% | 11.10% | 6.20% | 5.60% | 2.10% | 19.50% | 1.00% |

| 2022/12/30 | 77,542 | -2,590 | -3.34% | 28.60% | 9.30% | 21.90% | 5.10% | 10.00% | 2.00% | 2.00% | 20.20% | 1.10% |

| 2022/12/15 | 80,895 | 721 | 0.89% | 29.40% | 9.30% | 21.60% | 5.10% | 10.00% | 2.00% | 2.00% | 19.60% | 1.00% |

| 2022/11/30 | 70,621 | 467 | 0.66% | 46.00% | 12.30% | 2.00% | 5.20% | 9.90% | 2.00% | 1.90% | 19.60% | 1.00% |

米国債券の割合がさらに増えて40%を超えてます。そして新興国株式は20%程度減らしてます。

おおぶね Japan

主として国内の金融商品取引所に上場されている株式に投資し、投資信託財産の中長期的な成長を目指す。運用にあたっては、徹底したファンダメンタル分析に基づく、持続的に価値を創造する企業への長期投資、および、投資先へのエンゲージメント活動により、長期的なリターンの獲得を目指す。

おおぶね Japan の純資産総額が30億円と少なめなので、中小型株への投資のしやすさから、投資先として選定しました。為替が少し落ち着いてきたので、おおぶねの米国株版の投資も検討中・・。

おおぶね、最近ずっと増加してましたが、最近は減少中ですね。ついに10%を切ってしまった。9%付近まで下がってきました。今回も下落。

| 日付 | 資産総額 | 評価損益 | 評価損益率 |

| 2023/9/27 | 1,480,495 | 129,841 | 8.77% |

| 2023/9/26 | 1,490,587 | 139,934 | 9.39% |

| 2023/9/25 | 1,484,576 | 133,924 | 9.02% |

| 2023/9/22 | 1,488,773 | 138,119 | 9.28% |

| 2023/9/21 | 1,507,369 | 156,717 | 10.40% |

| 2023/9/20 | 1,520,636 | 169,984 | 11.18% |

| 2023/9/19 | 1,529,595 | 178,942 | 11.70% |

| 2023/9/15 | 1,488,812 | 168,153 | 11.29% |

| 2023/9/14 | 1,476,582 | 155,924 | 10.56% |

| 2023/9/13 | 1,484,254 | 163,595 | 11.02% |

| 2023/9/12 | 1,469,690 | 149,032 | 10.14% |

| 2023/9/11 | 1,475,471 | 154,812 | 10.49% |

| 2023/9/8 | 1,484,021 | 173,362 | 11.68% |

| 2023/9/7 | 1,490,425 | 179,766 | 12.06% |

| 2023/9/6 | 1,483,026 | 172,368 | 11.62% |

| 2023/9/5 | 1,478,279 | 167,620 | 11.34% |

| 2023/9/4 | 1,469,777 | 159,118 | 10.83% |

| 2023/9/1 | 1,452,209 | 151,569 | 10.44% |

| 2023/8/30 | 1,437,185 | 136,545 | 9.50% |

| 2023/8/15 | 1,415,690 | 115,050 | 8.13% |

| 2023/7/26 | 1,417,781 | 137,101 | 9.67% |

| 2023/7/14 | 1,406,534 | 125,853 | 8.95% |

| 2023/6/30 | 1,419,018 | 158,332 | 11.16% |

| 2023/6/15 | 1,433,415 | 172,729 | 12.05% |

| 2023/5/31 | 1,264,030 | 103,361 | 8.18% |

| 2023/5/15 | 1,239,906 | 79,236 | 6.39% |

| 2023/4/28 | 1,095,169 | 34,497 | 3.15% |

| 2023/4/14 | 1,087,270 | 26,598 | 2.45% |

| 2023/3/31 | 975,849 | 15,213 | 1.56% |

| 2023/3/15 | 948,337 | -12,299 | -1.30% |

| 2023/2/28 | 856,568 | -4,079 | -0.48% |

| 2023/2/15 | 869,278 | 8,630 | 0.99% |

| 2023/1/31 | 768,999 | 8,332 | 1.08% |

| 2023/1/16 | 736,838 | -23,829 | -3.23% |

| 2022/12/30 | 638,249 | -22,392 | -3.51% |

| 2022/12/15 | 672,545.01 | 12,530.17 | 1.86% |

| 2022/11/30 | 474,907.25 | 14,887.62 | 3.13% |

ひふみ投信

ひふみ投信は、「日本を根っこから元気にする」をコンセプトに、主に日本の成長企業に投資をする投資信託です。

アクティブファンドの老舗。純資産総額が1426億円ですがひふみプラスなど他の類似信託を合わせると運用資金が巨大となっているのが最近気になる点。

ひふみ投信は今回は増加・・・。 +10%はなんとか持ち堪えてる。

| 日付 | 資産総額 | 評価損益 | 評価損益率 |

| 2023/9/27 | 2,047,641.00 | 217,621.00 | 10.63% |

| 2023/9/26 | 2,052,610.00 | 222,590.00 | 10.84% |

| 2023/9/25 | 2,040,696.00 | 210,676.00 | 10.32% |

| 2023/9/22 | 2,040,823.00 | 210,803.00 | 10.33% |

| 2023/9/21 | 2,053,439.00 | 223,419.00 | 10.88% |

| 2023/9/20 | 2,071,311.00 | 241,291.00 | 11.65% |

| 2023/9/19 | 2,080,359.00 | 250,339.00 | 12.03% |

| 2023/9/15 | 2,068,826.00 | 238,806.00 | 11.54% |

| 2023/9/14 | 2,048,724.00 | 218,704.00 | 10.68% |

| 2023/9/13 | 2,053,917.00 | 223,897.00 | 10.90% |

| 2023/9/12 | 2,031,008.00 | 210,981.00 | 10.39% |

| 2023/9/11 | 2,030,913.00 | 210,886.00 | 10.38% |

| 2023/9/8 | 2,051,773.00 | 231,746.00 | 11.29% |

| 2023/9/7 | 2,061,125.00 | 241,098.00 | 11.70% |

| 2023/9/6 | 2,050,061.00 | 230,034.00 | 11.22% |

| 2023/9/5 | 2,045,559.00 | 225,532.00 | 11.03% |

| 2023/9/4 | 2,030,659.00 | 210,632.00 | 10.37% |

| 2023/9/1 | 2,019,151.00 | 199,124.00 | 9.86% |

| 2023/8/30 | 1,998,671.00 | 178,644.00 | 8.94% |

| 2023/8/15 | 1,971,500.00 | 161,470.00 | 8.19% |

| 2023/7/26 | 1,970,396.00 | 160,366.00 | 8.14% |

| 2023/7/14 | 1,950,744.00 | 140,714.00 | 7.21% |

| 2023/6/30 | 1,968,360.00 | 168,354.00 | 8.55% |

| 2023/6/15 | 1,956,812.00 | 156,806.00 | 8.01% |

| 2023/5/31 | 1,829,706.00 | 79,682.00 | 4.35% |

| 2023/5/15 | 1,731,672.00 | 31,644.00 | 1.83% |

| 2023/4/28 | 1,678,157.00 | -21,871.00 | -1.30% |

| 2023/4/14 | 1,672,630.00 | -27,398.00 | -1.64% |

| 2023/3/31 | 1,612,135.00 | -37,878.00 | -2.35% |

| 2023/3/15 | 1,569,272.00 | -80,741.00 | -5.15% |

| 2023/2/28 | 1,561,728.00 | -38,296.00 | -2.45% |

| 2023/2/15 | 1,557,873.00 | -42,151.00 | -2.71% |

| 2023/1/31 | 1,498,197.00 | -51,810.00 | -3.46% |

| 2023/1/16 | 1,454,090.00 | -95,917.00 | -6.60% |

| 2022/12/30 | 1,402,859.00 | -97,159.00 | -6.93% |

| 2022/12/15 | 1,444,301.00 | -55,717.00 | -3.86% |

| 2022/11/30 | 1,353,758.00 | -46,246.00 | -3.42% |

8月度の月次運用報告会とQA

ひふみ投信は新NISAの対象になったようです。

新NISAの投信1000本公表へ 2024年始動、毎月分配は除外https://t.co/q4bPtaqYnM

— 日本経済新聞 電子版(日経電子版) (@nikkei) June 21, 2023

公募投信は全体で約6000本。その中から初心者が扱いやすい投信をどう区分けするかが焦点でした。(無料記事です) pic.twitter.com/GGUeP8aqH6